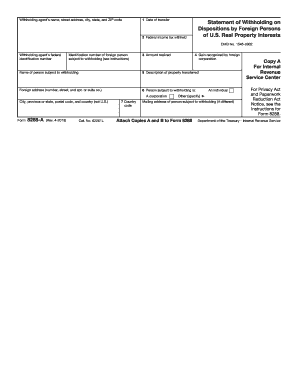

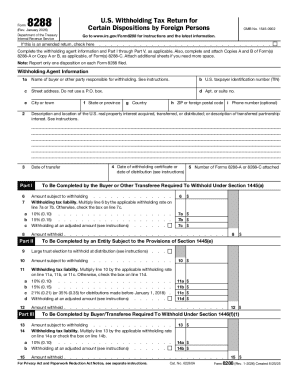

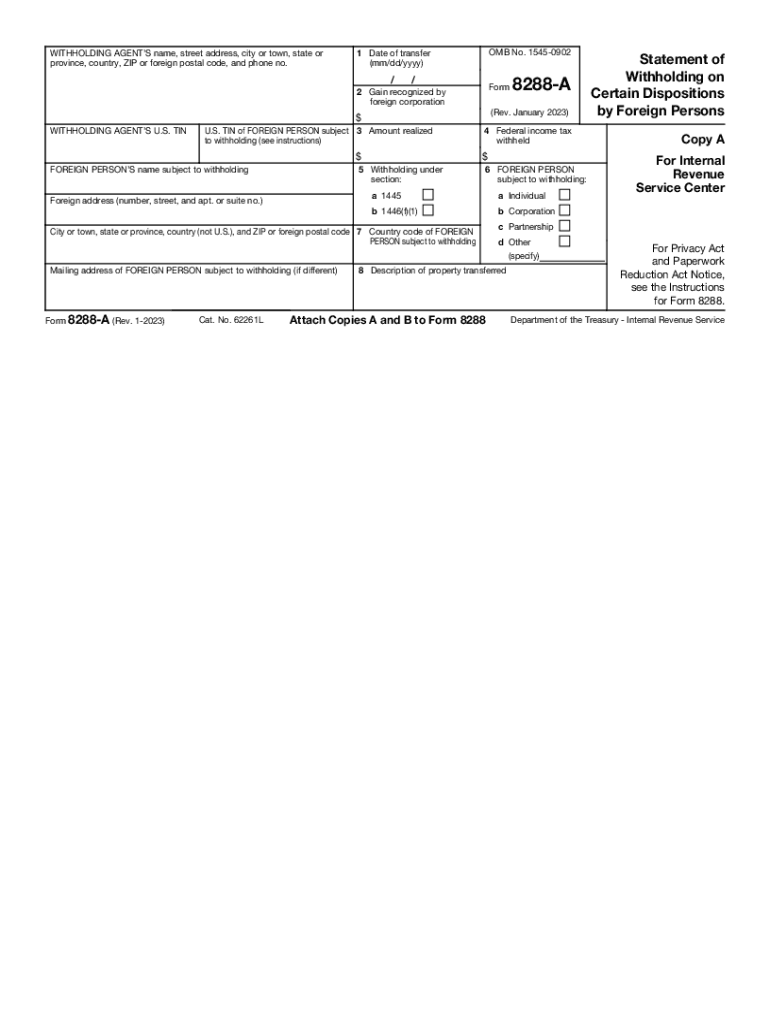

IRS 8288-A 2023-2026 free printable template

Instructions and Help about IRS 8288-A

How to edit IRS 8288-A

How to fill out IRS 8288-A

Latest updates to IRS 8288-A

All You Need to Know About IRS 8288-A

What is IRS 8288-A?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8288-A

What should I do if I notice an error in my IRS 8288-A after submission?

If you realize there is an error in your IRS 8288-A after filing, you can submit an amended return. It is advisable to clearly mark the amended form and indicate the corrections made. Keep copies of all documents for your records.

How can I verify the status of my submitted IRS 8288-A?

To verify the status of your submitted IRS 8288-A, you can check the IRS website or call the IRS helpline. Make sure to have your submission details available to facilitate the inquiry.

What should I do if my IRS 8288-A submission is rejected?

If your IRS 8288-A submission is rejected, review the rejection notice for the specific reasons. Common issues include missing information or incorrect calculations. Correct the errors and resubmit the form as soon as possible.

Are e-signatures accepted on the IRS 8288-A?

Currently, the IRS does accept e-signatures on the IRS 8288-A, provided that the e-signature complies with IRS guidelines. Ensure that all signatory requirements are met to avoid issues during processing.

How should I respond if I receive an audit notice related to my IRS 8288-A?

If you receive an audit notice regarding your IRS 8288-A, carefully review the notice for required documentation. Gather all relevant records and respond promptly, providing clear explanations for any discrepancies.