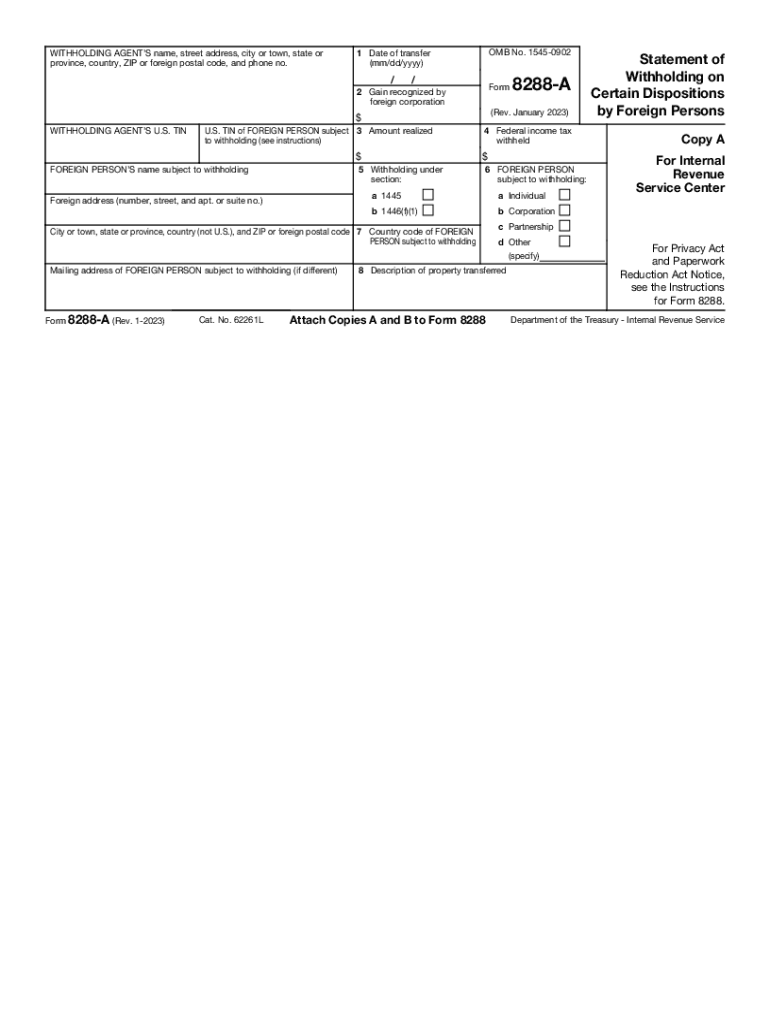

Who needs Form 8288-A?

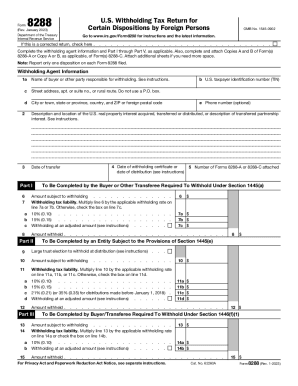

Form 8288-A is prepared by the withholding agent for each foreign individual subject to the submission of Form 8288, U.S. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property Interests.

What is the purpose of Form 8288-A?

The Statement of Withholding on Dispositions by Foreign Persons of U.S. Real Property Interests is submitted to the IRS together with Form 8288. If a foreigner disposes of their real property located in the US, the buyer should withhold 15% of the received amount. The successful sale is reported in an individual’s tax return and on Form 8288.

What documents must accompany Form 8288-A?

This form is attached to Form 8288. If the taxpayer wants to receive credit on their federal income taxes, this form is also attached to their tax return forms.

How long does it take to fill Form 8288-A out?

A taxpayer can complete the form in five minutes. The due date of the form submission depends on the purpose of filing.

What information should be provided in Form 8288-A?

The form must contain the following details:

- Name of the withholding agent

- Federal Identification Number of the Withholding agent

- Name and Identification number of the person subject to withholding, foreign address

- Date of transfer

- Federal income tax withheld

- Description of the transferred property

Form 8288-A consists of two copies. Copy A is for the IRS, copy B is to be sent to the person subject to withholding. They will use it when preparing tax return forms.

What do I do with the form after its completion?

The withholding agent forwards the form to the IRS and to the person subject to withholding.